Crypto: How Many L1's Will Exist in 5 Years?

A prediction from March 16, 2022

The crypto landscape is anything but flat. My last article touched on L1s, the necessity of L2s, and how it all intertwines. However, it got me thinking, what will it look like in five years?

L1 refers to a primary blockchain network. Bitcoin and Ethereum are two well-known examples, but many others like Solana, Avalanche, Binance Smart Chain, Algorand, and Cardano have popped up. Are the new L1s here to stay?

The Blockchain Trilemma

Security, decentralization, and scalability – pick two. Just like in real estate, you can buy a beautiful house for a great price, but you'll likely sacrifice location.

The two largest L1s, Bitcoin and Ethereum, sacrificed scalability in favor of security and decentralization. Doing so laid the groundwork for Web 3.0 and helped it gain adoption. Plus, they could handle the relatively low volume of transactions, with Bitcoin processing seven transactions per second (tx/s) and Ethereum 15 tx/s.

However, their scalability, or lack thereof, created a real pain point for consumers as the wait times and cost of transactions ballooned due to network activity. Imagine standing in the grocery store waiting for the chip card reader to say "remove card" for an uncomfortably long time; nobody wants that.

The rise of L2s and alternative L1s tackled that very issue.

New L1s in Town

Many alternative L1s provide fast speeds and low transaction costs – crucial for consumers in the space. And their approaches have varied; some forked from Ethereum and made improvements (Avalanche) while others took utterly novel approaches. For instance, Solana is the first to leverage a new Proof-of-History validation model. Regardless of the how, the market has rewarded them with impressive market caps.

But at What Cost?

While sporting faster transaction speeds in all cases, it often comes at the cost of one of the other pillars.

Security

The Bitcoin and Ethereum blockchains have been around the longest and have earned many battle scars. Hackers attacked the chains on multiple occasions, yet it provided the community a chance to rectify and future proof it from happening again. With any new technology, there will be hiccups and learning experiences along the way. Alternative L1s have yet to be battle-tested and stand the test of time. Solana, released in April 2019, even went offline in September of 2021 after a surge of transactions.

Decentralization

Other L1s sacrificed decentralization for scalability. To compete with Ethereum, the Binance Smart Chain (BSC) has a network of only 21 validating nodes – many of which are owned and operated by Binance. Compare this to over 200,000 validating nodes owned by users globally in the Ethereum network.

Ethereum's Play

ETH 2.0

L2s have resolved some congestion by moving transactions off the main Ethereum chain. The longer-term solution, ETH 2.0, is currently underway and slated to go live in 2023.

Ethereum 2.0 will drastically improve the number of transactions by updating its validation method. Today it uses proof-of-work (POW), like Bitcoin. POW requires powerful computers to solve complex algorithms to earn the right to mine the next block in the chain. Moving to proof-of-stake (POS), the computers are algorithmically selected to validate the next block, with the unchosen computers verifying their work. Doing so will increase transaction speeds, and since the computers are no longer competing, the blockchain will consume way less energy.

How Fast is Fast?

Founder Vitalik Buterin claims ETH 2.0 can reach 100,000 tx/s! To put that in perspective, today, Ethereum processes roughly 1.2m transactions daily, and its capacity will balloon to handle 8.64b transactions. That is a 700,000% increase. When we reach that volume of transactions, the world will be a very different place, with so much living on the blockchain.

The X Factor

When assessing the viability of a blockchain, there is another critical factor to consider – perhaps even a 4th leg to the stool – inertia.

The brainpower and money flowing into Ethereum is staggering, with close to 3,000 dapps alone built on top of its network! The other L1s have not benefited from that type of engagement. Developers spend their time building in the Ethereum ecosystem, attracting users, which attracts more developers. The flywheel is real, and it's spinning fast.

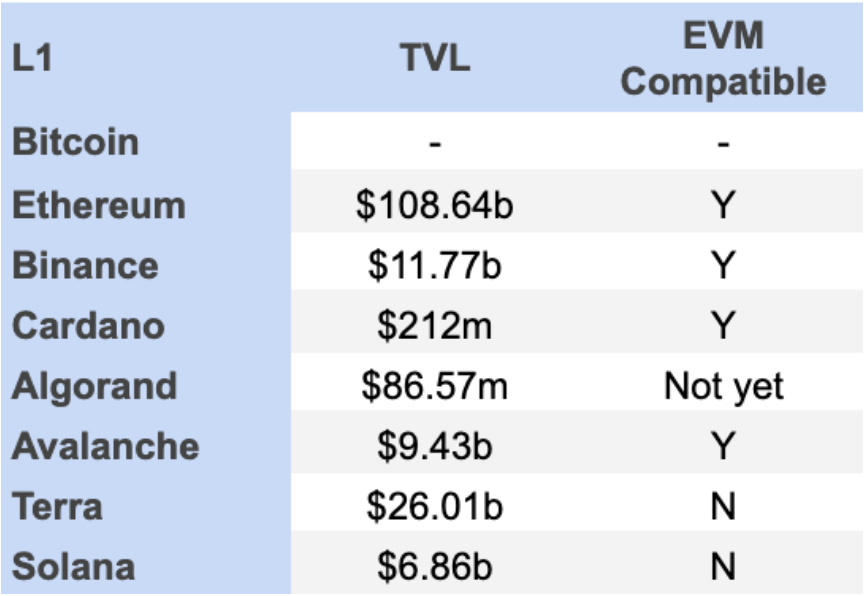

Some L1s are already Ethereum virtual machine (EVM) compatible, whereas others, like Algorand, are offering $10mm incentives for developers to create EVM compatible dapps. Becoming EVM compatible enables dapps written for one chain to work on Ethereum. Other L1s like Solana use a unique programming language, RUST, making it not EVM compatible today.

Plus, what's a flywheel without money involved? Ethereum boasts the most amount of money locked into its protocol. Specifically, users who own ETH and believe in the chain have put their money where their mouth is and invested it back into the chain.

Wrapping It Up

The fast speeds and low transaction costs of alternative L1s enabled them to capture market share; however, the temporary fix that is L2 has removed some of that competitive advantage, providing ETH 2.0 breathing room to get to market. Once live, it will directly compete with the low speed and costs of the alternative L1s.

Further, from the security and decentralization point of view, Ethereum proves its worth as it advances on both fronts. While the release of ETH 2.0 certainly carries risk, barring some catastrophic meltdown, it will be here to stay. The momentum and energy behind it will drive its flywheel forward.

In the late 90s and early 2000s, there were over 20 search engines. While a few still exist, many fell to the wayside. Similarly, I think Ethereum is the Google of our time and will continue to grow and thrive as the underlying settlement layer of almost all (90%) of blockchain transactions. Any remaining L1s will be EVM compatible, and the L2s will need to adapt or become obsolete.

Bitcoin will always have a special place as a payments platform. Its brand equity alone is synonymous with cryptocurrency and is known globally. Plus, advancements in the lightning network have made Bitcoin microtransactions feasible from a cost and speed perspective.